Personal Auto Umbrella Policy. According to the insurance information institute, a $1 million umbrella. Our personal umbrella insurance can help to keep you covered.

Our personal umbrella insurance can help to keep you covered. With limits ranging from $1 million to $5 million, it can complete your package of insurance protection. Personal umbrella insurance policies are not very common.

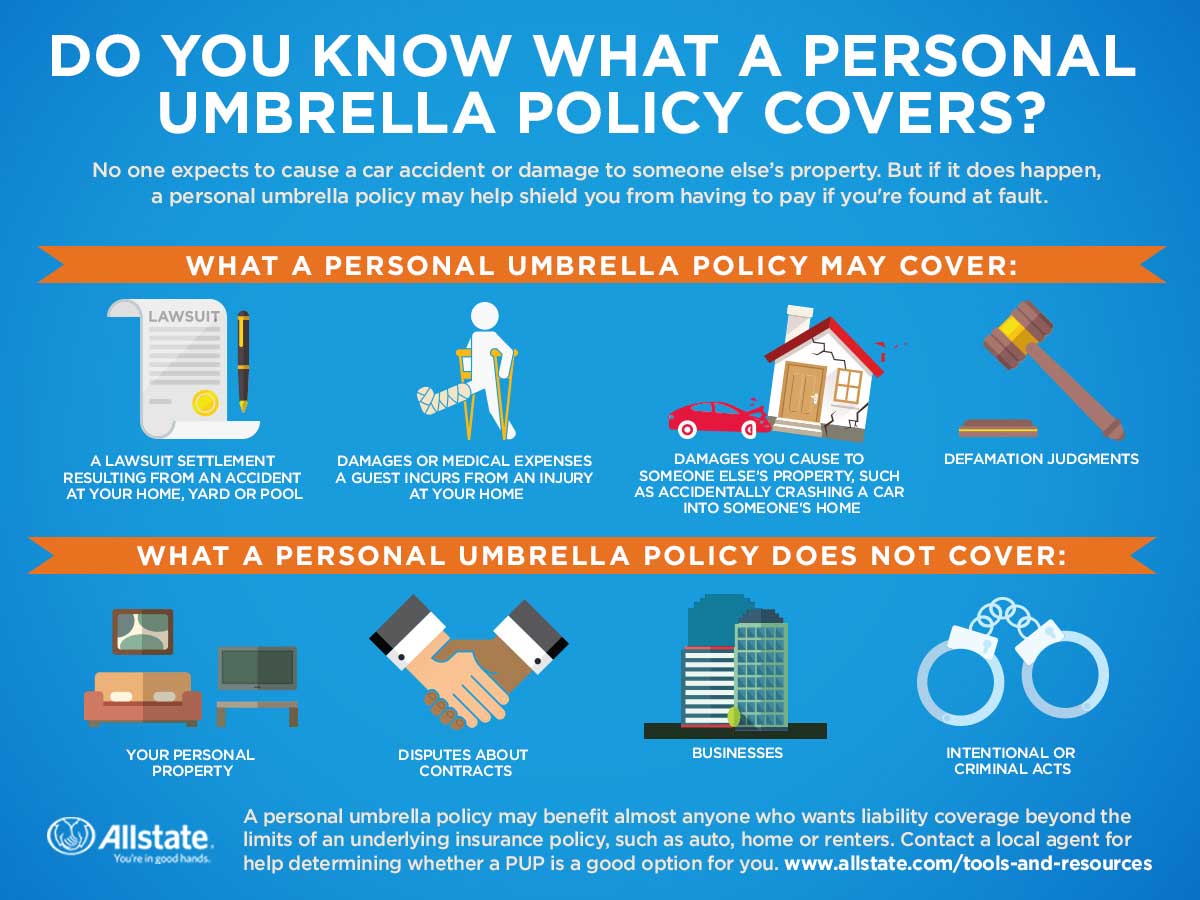

An umbrella policy protects you against a catastrophic liability loss.

They are sold in $1 million increments. Personal umbrella insurance policies are not very common. Personal umbrella liability is unique from other regular insurance policies and comes to help whenever the damages are beyond the liability protection. State farm is the largest.