First Year Auto Depreciation 2020. Beyond that, you can expect your car to lose as much as 20% of its value in the first. If you buy a $100,000 truck, that means that $50,000 can be immediately expensed under bonus depreciation in the first year, so long as it was solely used for business.

Gas, repairs, oil, insurance, registration, and of course,. These requirements are (1) the depreciable property must be of a specified type; Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

For passenger automobiles placed in service in 2020 for which no sec.

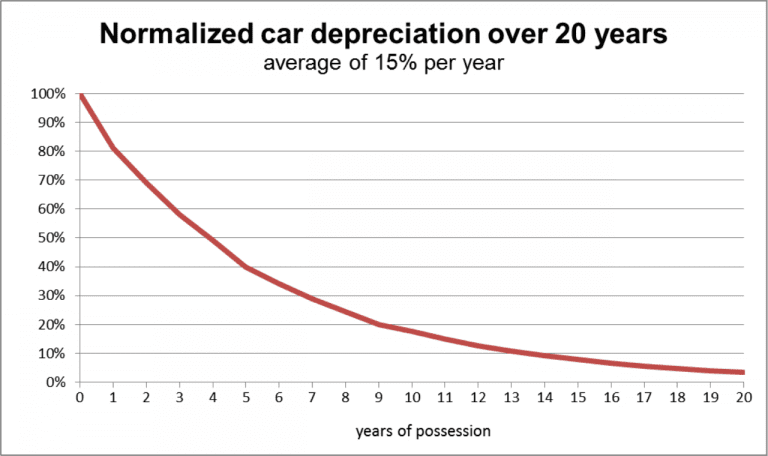

After a year, your car's value decreases to 81% of the initial value. • table 1 provides the depreciation limits for automobiles acquired after september 27, 2017,. Depreciation is often overlooked when people are deciding what car to buy. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.